How to Choose the Right Marine Insurance for Monsoon Season

Navigating the monsoon season can be particularly challenging for maritime operations and cargo shipments. Heavy rains, strong winds,

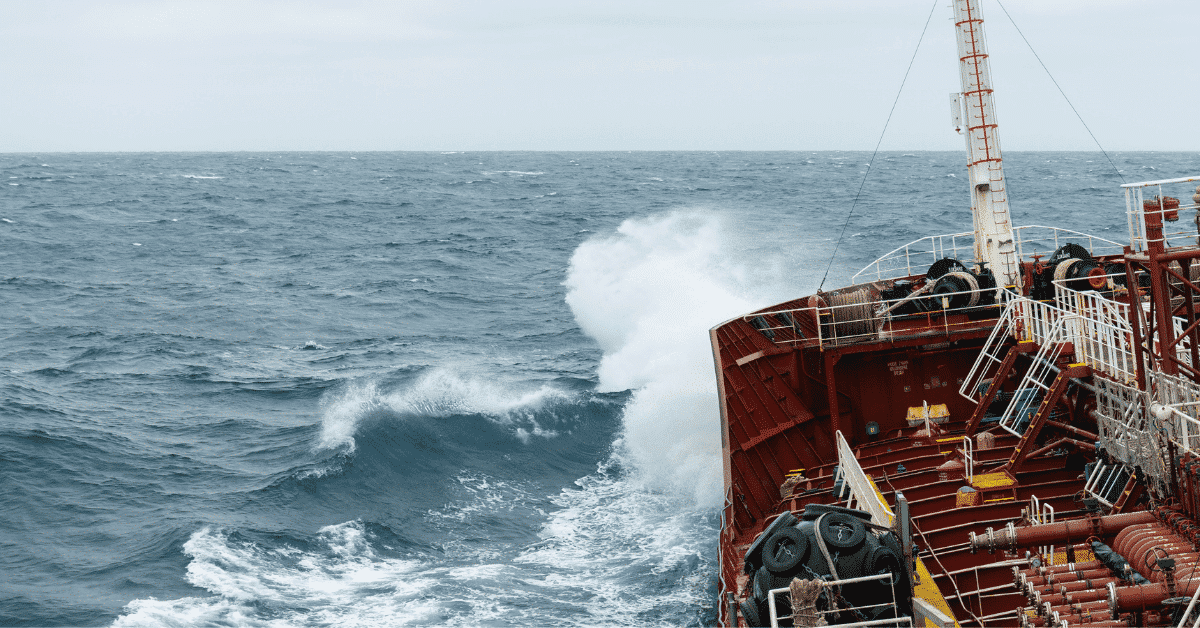

Navigating the monsoon season can be particularly challenging for maritime operations and cargo shipments. Heavy rains, strong winds, and turbulent seas significantly increase the risks involved, making robust marine insurance essential. This comprehensive guide will help you select the right coverage tailored for monsoon-related risks.

Understanding Monsoon Challenges

The monsoon season brings a range of adverse weather conditions that can disrupt maritime operations. Heavy rains can lead to water damage, corrosion, and mold growth, while strong winds and turbulent seas can increase the risk of accidents and delays. These conditions pose significant threats to cargo, potentially leading to loss or damage if not properly insured. Understanding these challenges is the first step in ensuring your marine insurance adequately protects your assets.

Key Features of Marine Insurance

-

Comprehensive Coverage Options

Marine Cargo Insurance: This type of insurance is designed to protect against physical loss or damage to goods during transit. It is particularly crucial during the monsoon season, as it covers damage caused by adverse weather conditions. Marine cargo insurance ensures that your cargo is protected against risks such as water ingress, storm damage, and other monsoon-related issues.

Transit Insurance Online: Modern technology offers convenient platforms for purchasing insurance tailored to specific shipping routes and cargo types. These online tools allow businesses to find comprehensive coverage quickly and efficiently, ensuring that their shipments are protected throughout the journey.

-

Factors to Consider When Choosing Insurance

Coverage Limits: When selecting marine insurance, it's vital to ensure that the policy covers all potential risks relevant to monsoon weather. This includes water ingress, storm damage, and delays caused by adverse conditions. Adequate coverage limits are essential to safeguard your cargo from financial loss.

Policy Exclusions: Understanding the exclusions of a policy is equally important. Common exclusions include acts of war, piracy, and certain natural disasters that may not be covered. Being aware of these exclusions helps in assessing the comprehensiveness of your coverage and avoiding surprises when filing a claim.

Claims Process: Evaluate the ease and efficiency of the claims process, especially during emergencies or unforeseen incidents. A streamlined and responsive claims process ensures that you receive timely compensation and support, which is crucial during the unpredictable monsoon season.

-

Importance of Best Marine Insurance During Monsoon Season

Risk Mitigation: Proper marine insurance protects businesses from financial losses due to cargo damage or loss caused by monsoon-related hazards. It helps mitigate the risks associated with adverse weather conditions, ensuring that your investment is safeguarded.

Operational Continuity: Marine insurance also plays a critical role in maintaining operational continuity. By providing coverage for delays and disruptions caused by adverse weather, it ensures that operations remain smooth and deliveries are made on time, even during challenging conditions.

Tips for Choosing the Right Marine Insurance

-

Assess Specific Risks

Evaluate the specific risks your cargo faces during the monsoon season. This includes exposure to moisture, rough seas, or potential accidents. Understanding these risks will help you select a policy that offers adequate protection for your particular needs.

-

Review Policy Terms Carefully

Scrutinize the policy terms, conditions, and exclusions to ensure they align with your cargo’s needs and potential exposure to monsoon-related risks. Pay close attention to the details of coverage limits, exclusions, and the claims process to make an informed decision.

-

Compare Multiple Quotes

Use online platforms like DgNote Technologies to compare quotes from different insurers. These platforms facilitate seamless comparisons, allowing you to find the best marine insurance online that offers comprehensive coverage at competitive rates. Comparing quotes ensures that you select a policy that provides the best value for your investment.

-

Seek Expert Advice

Consult with insurance professionals or brokers who specialize in marine insurance. Their expertise can provide valuable insights and recommendations based on your specific requirements. An expert can help you navigate the complexities of marine insurance and ensure that you choose the right policy for your needs.

Choosing the right marine insurance for the monsoon season is crucial for protecting your cargo and maintaining operational continuity. By understanding the challenges posed by monsoon weather, evaluating key features of marine insurance, and following the tips provided, you can select a policy that offers comprehensive coverage and peace of mind.

For businesses seeking reliable marine insurance tailored for the monsoon season, DgNote Technologies offers a user-friendly platform to explore and purchase policies. Their online tools facilitate seamless comparisons of transit insurance and marine cargo insurance options, ensuring that you find optimal coverage that effectively protects against monsoon-related risks. Trust DgNote Technologies to provide comprehensive support and peace of mind throughout the unpredictable monsoon period.

FAQs

-

What specific risks should be considered during the monsoon season?

During the monsoon season, consider risks such as exposure to moisture, rough seas, water damage, storm damage, and potential delays due to adverse weather conditions.

-

How can I ensure my marine insurance covers all potential monsoon-related issues?

Ensure your policy includes coverage for water ingress, storm damage, and delays caused by adverse weather. Review the policy terms carefully and consult with insurance professionals if needed.

-

What should I look for in the claims process of a marine insurance policy?

Look for a claims process that is streamlined, responsive, and efficient. The process should provide timely compensation and support, especially during emergencies or unforeseen incidents.

-

How do online platforms help in finding the right marine insurance?

Online platforms like DgNote Technologies allow you to compare quotes from different insurers, facilitating the selection of comprehensive coverage at competitive rates. They provide convenience and efficiency in finding the right marine insurance for your needs.

What's Your Reaction?