How to Plan for Changing Life Insurance Needs Through Life

Learn how to plan for changing life insurance needs throughout life with our practical guide. This video covers strategies for adjusting your life insurance policy as your circumstances evolve, including changes in family size, career, and financial goals. Discover how to review and update your coverage to ensure it continues to meet your needs at every stage of life.

.jpg)

In life, change is the only constant, and this is especially true when it comes to personal circumstances, financial situations, and responsibilities. As your life evolves, so too will your needs for life insurance. The journey of planning for life insurance can be intricate, as it requires not just an understanding of your current situation but also foresight into future possibilities. Whether it’s marriage, parenthood, career changes, or retirement, adapting your life insurance policy to meet your changing needs is essential. This guide will explore how to effectively plan for your evolving life insurance requirements and ensure that you and your loved ones remain protected.

Understanding the Basics of Life Insurance

Before diving into planning for changing life insurance needs, it’s crucial to understand the fundamentals of life insurance. Life insurance is a contract between you and an insurance company, where the insurer provides a death benefit to your beneficiaries in exchange for regular premium payments. This benefit can help cover expenses such as mortgage payments, college tuition, and daily living costs, ensuring your loved ones can maintain their quality of life after your passing.

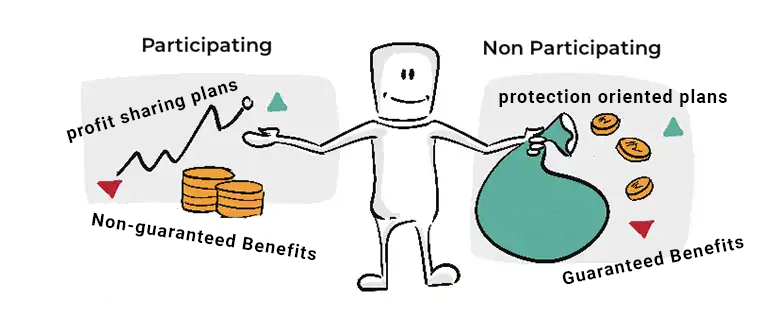

There are two primary types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from ten to thirty years, while permanent life insurance provides coverage for your entire life, often accumulating cash value over time. Understanding these options is vital as you assess your life insurance needs throughout various life stages.

Recognizing Life Stages That Affect Insurance Needs

Life events significantly impact your insurance requirements. By recognizing these key life stages, you can better anticipate when adjustments to your life insurance coverage might be necessary.

Marriage

When you tie the knot, your financial responsibilities often change. Your partner may rely on your income, and joint financial obligations may arise, such as mortgage payments or shared debt. Reviewing your life insurance policy after marriage is essential to ensure that your coverage reflects your new circumstances and provides adequate support for your spouse in case of your untimely death.

Parenthood

The arrival of children brings about new responsibilities and financial obligations. You want to ensure that your children’s future is secure, including their education and upbringing. Increasing your life insurance coverage after becoming a parent is a prudent step. Consider the costs associated with raising a child, such as daycare, education, and other expenses, when determining how much coverage you need.

Career Changes

A change in employment can lead to fluctuations in income, benefits, and financial responsibilities. If you experience a significant salary increase, you may want to increase your life insurance coverage to reflect your enhanced earning potential and responsibilities. Conversely, if you change to a job with lower pay or benefits, you might need to reassess your coverage needs and adjust accordingly.

Homeownership

Purchasing a home is often one of the largest financial commitments individuals make. A mortgage represents a significant responsibility, and life insurance can play a crucial role in protecting your family from the burden of mortgage payments in the event of your death. Reassessing your life insurance coverage after buying a home can provide peace of mind that your loved ones can maintain their home.

Retirement

As you approach retirement, your financial landscape changes. You may have paid off significant debts, including your mortgage, which can reduce your life insurance needs. However, your retirement savings may not be sufficient to cover your spouse’s living expenses after your passing. Evaluating your life insurance policy during retirement planning is essential to ensure your spouse is financially secure.

Assessing Your Current Life Insurance Coverage

Understanding your existing life insurance coverage is critical in planning for changing needs. Take time to review your current policy to assess its adequacy. Consider the following factors:

- Coverage Amount: Is your current coverage sufficient to meet your family’s needs? Evaluate the financial responsibilities your loved ones would face in your absence.

- Beneficiaries: Are your beneficiaries up-to-date? Life events like marriage or divorce may necessitate changes to who will receive the death benefit.

- Policy Type: Is your policy type still appropriate for your situation? For instance, if your needs have evolved into lifelong coverage, transitioning from term to permanent insurance might be worth considering.

Estimating Future Life Insurance Needs

Estimating your future life insurance needs requires careful thought and planning. Start by identifying significant future life events that may occur. Think about the following aspects:

- Financial Goals: What are your long-term financial objectives? Consider major expenses, such as buying a new home or funding your children’s education.

- Inflation: Factor in inflation when calculating future financial needs. The cost of living will increase over time, affecting your family's financial security.

- Life Expectancy: Consider your family’s health history and life expectancy. This will help you determine the duration of coverage you may need.

Creating a Comprehensive Life Insurance Strategy

Once you have assessed your current coverage and estimated future needs, you can create a comprehensive life insurance strategy. Here are several steps to help you develop an effective plan:

Consult a Financial Advisor

Engaging with a financial advisor can provide valuable insights into your insurance needs and financial goals. They can help you analyze your current situation, assess risks, and develop a tailored life insurance strategy that aligns with your long-term objectives.

Choose the Right Type of Policy

Selecting the appropriate type of life insurance policy is crucial. If you require coverage for a specific period, term life insurance may be ideal. However, if you want lifelong coverage that builds cash value, permanent life insurance might be a better fit. Evaluate the pros and cons of each type to make an informed decision.

Determine Adequate Coverage

Calculate the coverage amount you need by evaluating your current and future financial responsibilities. Consider expenses such as debts, mortgage payments, children’s education, and daily living costs. This assessment will help you establish a suitable coverage amount that can provide for your loved ones.

Review Regularly

Life insurance needs are not static; they change as life unfolds. Schedule regular reviews of your life insurance coverage, ideally every few years or after significant life events. This practice ensures your policy remains aligned with your evolving needs and financial circumstances.

Consider Riders for Additional Coverage

Riders are additional features that can be added to your life insurance policy to enhance coverage. For example, a child rider allows you to add coverage for your children, while a disability rider provides benefits if you become disabled. Assess your potential needs for these riders and consider incorporating them into your policy.

Understanding the Claims Process

In the unfortunate event that your loved ones must file a claim, understanding the claims process is essential. Familiarize yourself with the following steps to ensure a smoother experience:

- Notification: Your beneficiaries should promptly notify the insurance company of your passing. This typically involves submitting a claim form along with a certified copy of the death certificate.

- Documentation: The insurer may require additional documentation, such as identification and any relevant policy information. Ensuring all necessary documents are available can expedite the process.

- Review: The insurance company will review the claim to ensure it meets the policy’s terms and conditions. This review may take several weeks.

- Payment: Once approved, the insurer will issue the death benefit payment to the designated beneficiaries.

The Importance of Open Communication

Open communication with your loved ones regarding life insurance is vital. Discuss your policies, coverage amounts, and any changes you plan to make. This transparency will help your family understand their options and responsibilities in the event of your passing.

Encourage your family to ask questions and express their concerns. This dialogue can lead to a better understanding of the importance of life insurance and its role in securing their financial future.

Final Thoughts on Life Insurance Planning

Planning for changing life insurance needs is an ongoing process that requires foresight, adaptability, and a proactive approach. By recognizing significant life events, assessing current coverage, and creating a comprehensive strategy, you can ensure that your loved ones are well protected regardless of the circumstances.

The evolving nature of life demands that you stay informed and engaged with your life insurance needs. Regularly reviewing your policies, seeking professional advice, and maintaining open communication with your family can significantly enhance your planning efforts. Ultimately, a well-structured life insurance plan is not just about providing financial support; it’s about ensuring peace of mind for you and your loved ones during life’s unpredictable journey.

FAQs

What factors influence life insurance needs?

Life insurance needs are shaped by various factors such as marital status, number of dependents, income level, existing debts, and significant life events like buying a home or having children.

How often should I review my life insurance policy?

It is recommended to review your life insurance policy every few years or after any major life changes, such as marriage, divorce, the birth of a child, or changes in employment.

Can I adjust my life insurance policy type in the future?

Yes, you can change your life insurance policy type later on. However, this may require a new application and potentially higher premiums based on your current age and health status.

How can I determine the right amount of coverage?

To find the appropriate coverage amount, assess your current and future financial responsibilities, including debts, living expenses, educational costs for your children, and any other obligations that your family would need to cover in your absence.

What happens if I outlive my term life insurance policy?

If you outlive your term life insurance policy, the coverage will expire at the end of the term. You may have options to renew or convert it to a permanent policy, but premiums may increase due to your age.

Are there life insurance options available for individuals with pre-existing health conditions?

Yes, people with pre-existing health conditions can typically find life insurance. However, premiums may be higher. It is advisable to shop around and compare different insurers to find the best coverage.

What is the claims process for life insurance?

The claims process involves notifying the insurance company of the policyholder’s death, submitting a claim form along with a certified copy of the death certificate, and providing any additional required documentation. The insurance company will review the claim before issuing the death benefit to the beneficiaries.

How can I ensure my beneficiaries are up to date?

Regularly reviewing your life insurance policy and discussing it with your family can help ensure your beneficiaries are current. Major life events like marriage, divorce, or the birth of a child may necessitate updates to your beneficiary designations.

Is it possible to have multiple life insurance policies?

Yes, individuals can hold multiple life insurance policies. This can provide additional coverage to meet changing needs, but it is important to evaluate whether the total coverage is adequate and if it fits within your budget.

Can I add riders to my life insurance policy?

Yes, many life insurance policies allow you to add riders, which are additional benefits that can enhance your coverage. Common riders include accidental death benefits, child riders, and disability riders, among others.

What's Your Reaction?

:fill(white):max_bytes(150000):strip_icc()/HavenLife-49283207c70446fc93af6e989d6fcb77.jpg)