Understanding the Importance of Marine Insurance During the Monsoon Season

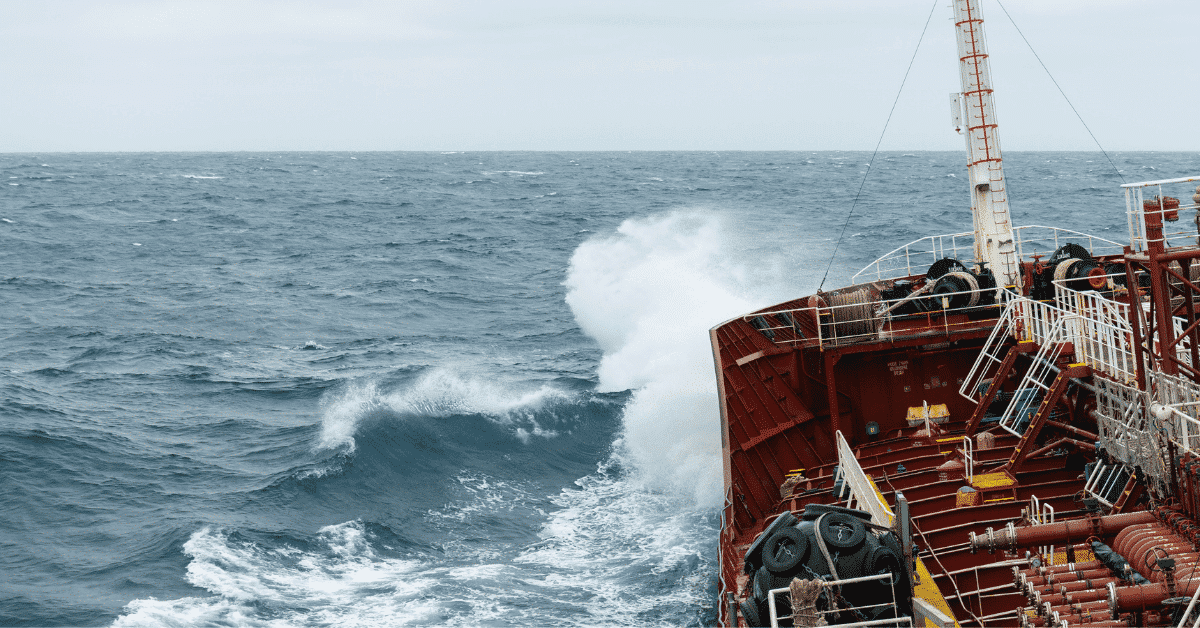

The monsoon season brings a unique set of challenges for marine cargo shipments, making the role of marine insurance crucial for protecting businesses from potential risks.

Frequently Asked Questions (FAQ) About Marine Insurance During the Monsoon Season

1. What is marine insurance and why is it important during the monsoon season?

Marine insurance provides financial coverage for goods transported by sea, protecting against various risks such as weather-related damage, accidents, theft, and piracy. During the monsoon season, the increased risk of heavy rainfall, turbulent seas, and strong winds makes marine insurance particularly important for safeguarding cargo and maintaining supply chain continuity.

2. How does marine insurance protect against weather-related risks?

Marine insurance policies can include provisions specifically addressing weather-related risks, such as water damage from heavy rains or delays due to adverse conditions. This protection ensures that businesses are financially covered for potential damage and disruptions caused by unpredictable weather during the monsoon season.

3. What other risks does marine insurance cover besides weather-related issues?

In addition to weather-related risks, marine insurance covers a range of other potential hazards, including mishandling of cargo during loading or unloading, accidents during transport, theft, and piracy in certain regions. This comprehensive coverage ensures that goods are protected throughout the shipping process.

4. How does marine insurance help with compliance to trade contracts?

Many trade contracts and agreements require that goods be insured during transit. Marine insurance helps businesses comply with these contractual obligations, reducing the risk of legal disputes and potential liabilities. Proper insurance coverage demonstrates responsible business practices and protects all parties involved in the supply chain.

5. What happens if cargo is completely lost or irreparably damaged?

In cases of total loss or irreparable damage to cargo, marine insurance provides financial compensation based on the insured value of the goods. This compensation helps businesses recover financially without bearing the full burden of the loss, allowing them to focus on their core operations.

6. How can businesses find the right marine insurance coverage?

Choosing the right marine insurance provider is crucial for obtaining tailored solutions that meet specific business needs. DgNote Technologies offers comprehensive marine insurance options online, allowing businesses to compare policies, understand coverage details, and secure the most appropriate insurance. Their expertise and user-friendly platform ensure personalized support and reliable coverage.

7. What benefits does partnering with DgNote Technologies offer?

Partnering with DgNote Technologies provides access to competitive rates, expert advice, and efficient claims processing. Their online platform makes it easy for businesses to explore various marine insurance policies, compare rates, and select the best coverage for their needs. DgNote Technologies ensures that clients receive personalized support and reliable insurance solutions.

8. How can businesses get started with marine insurance through DgNote Technologies?

Businesses interested in marine insurance can visit the DgNote Technologies website to explore their range of insurance options. The platform allows users to compare policies, review coverage details, and obtain quotes. For personalized support and further assistance, businesses can contact DgNote Technologies’ team of experts who will guide them through the process.

What's Your Reaction?