Crucial Role of Marine Insurance in Protecting Against Cargo Damage | DgNote

Marine insurance serves as an essential safety measure for shippers, offering a crucial layer of protection against the many risks involved in transporting goods,

Marine insurance serves as an essential safety measure for shippers, offering a crucial layer of protection against the many risks involved in transporting goods, particularly by sea. Cargo damage during transit is a common concern for shippers, whether they are moving perishable goods, valuable commodities, or fragile items. This is where marine insurance plays an indispensable role, providing financial security and peace of mind.

DgNote Technologies has made the process of finding marine insurance coverage simpler and more accessible. Through its advanced, user-friendly platform, shippers can compare policies, receive personalized recommendations, and choose the best marine insurance coverage tailored to their needs. This blog delves into the importance of marine insurance in protecting against cargo damage and how DgNote Technologies can assist in securing the right coverage.

Understanding Cargo Damage Risks

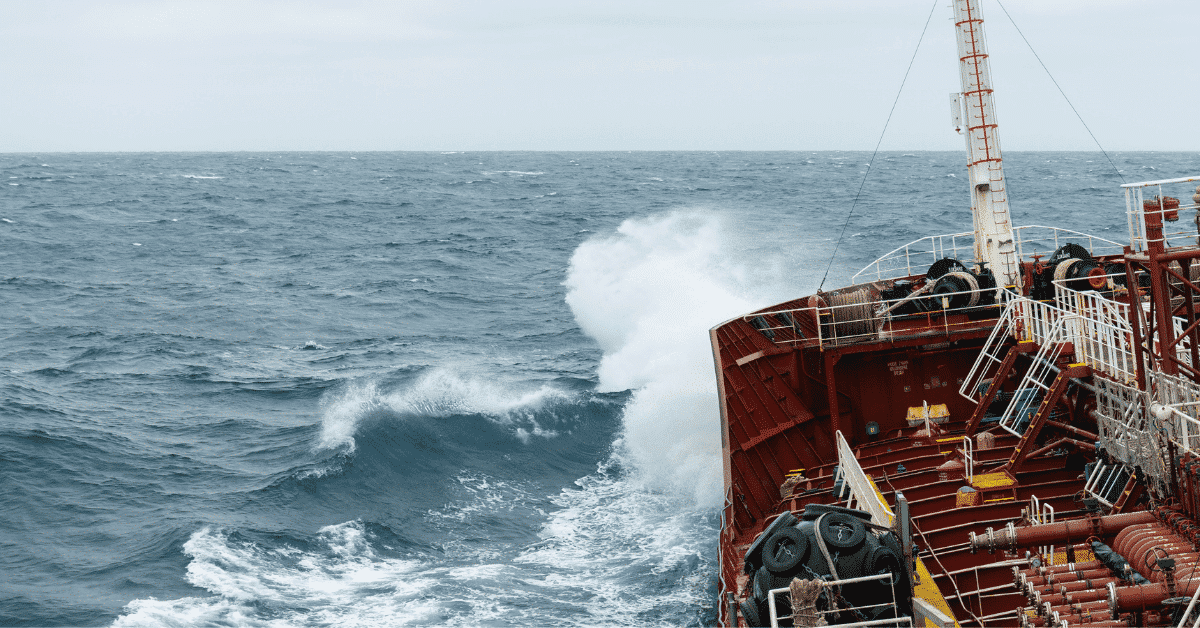

During transit, cargo is vulnerable to a wide range of risks that can lead to damage. These risks can stem from natural causes or human error. Cargo can be damaged due to rough weather conditions at sea, mishandling during loading and unloading, theft, accidents, and even unforeseen events such as fires or floods. Regardless of the type of cargo—whether it's fragile, perishable, or high in value—the financial impact of cargo damage can be substantial.

Rough weather, for instance, can toss cargo-laden ships in all directions, resulting in damage to even the sturdiest of containers. Similarly, mishandling at port or theft during transit can significantly compromise the value of the cargo. When cargo damage occurs, the shipper faces not only a financial setback but also potential delays in the supply chain, which can further complicate business operations.

Given these risks, shippers must mitigate their potential losses with the help of marine insurance. This insurance serves as a financial safeguard that ensures compensation if cargo is damaged or lost during transit.

Comprehensive Coverage for Cargo Damage

Marine insurance offers comprehensive coverage, ensuring that shippers are well protected against the multitude of risks they may face. Cargo insurance policies typically cover losses or damages due to theft, fire, water damage, accidents, and other unforeseen circumstances during transportation by sea, air, or land. The primary goal of this coverage is to safeguard shippers from the financial consequences of damage that may arise due to circumstances beyond their control.

This comprehensive coverage includes a wide range of cargo types, from perishable goods that may spoil during transport, to fragile items that can be easily damaged, and high-value commodities that are more susceptible to theft. By securing the right marine insurance, shippers can minimize their financial exposure to these risks, ensuring that their business operations continue smoothly even if damage occurs.

DgNote Technologies simplifies the process of finding the ideal marine insurance coverage. Through their online platform, users can access various insurance policies, compare the benefits of each, and select the one that best suits their specific needs. Whether you are shipping delicate electronics, fresh produce, or high-value jewelry, DgNote helps ensure that you find the right level of coverage for your cargo.

Protection Against Unforeseen Events

Unforeseen events can occur at any stage during the shipping process, and these events often lead to cargo damage. For example, a sudden storm could cause a ship to capsize, or a collision with another vessel might result in significant damage to both the ship and its cargo. In more extreme cases, acts of piracy could lead to the loss of goods in transit.

Marine insurance provides shippers with protection against these unexpected events, ensuring that even in the face of such disasters, they are not left to shoulder the financial burden alone. Whether the damage is caused by natural disasters or human actions, marine insurance helps cover the costs, giving shippers peace of mind. Without this protection, shippers could face catastrophic financial losses, jeopardizing their business.

This coverage is particularly important for international trade, where the risk of piracy and severe weather conditions increases. Even on shorter domestic voyages, unforeseen incidents such as fires, accidents at port, or water damage during transit can severely impact the condition of the cargo.

By offering comprehensive coverage against these unpredictable risks, marine insurance ensures that shippers are protected at every stage of their cargo's journey. DgNote Technologies understands the importance of finding the right coverage and works to provide users with the best options available.

Claims Process for Cargo Damage

In the unfortunate event that cargo is damaged during transit, the claims process becomes critical. Marine insurance providers typically have well-established, streamlined processes to handle claims efficiently, ensuring that shippers receive timely compensation for their losses. The claims process involves filing a claim for the damaged goods, presenting relevant documentation (such as proof of damage), and waiting for the insurer to evaluate and settle the claim.

Once a claim is filed, the insurance provider investigates the incident and assesses the damage. This investigation often involves gathering reports from both the shipper and any third parties involved in the transit process. After assessing the validity of the claim, the insurance company then reimburses the shipper for the value of the damaged cargo.

A smooth claims process is essential for shippers, as delays in compensation can disrupt business operations. Shippers depend on timely settlements to recover their losses and continue their supply chain activities without interruptions.

DgNote Technologies simplifies the process of finding an insurer with an efficient claims process. By using their platform, shippers can review insurance providers that are known for their reliability and fast claim settlements, ensuring that they can recover their losses without unnecessary delays.

DgNote Technologies: Simplifying Marine Insurance

For shippers, navigating the world of marine insurance can often be complex and overwhelming. There are numerous policies to choose from, and understanding the details of each can be time-consuming. This is where DgNote Technologies comes in, offering a platform that simplifies the entire process of finding and securing marine insurance.

DgNote's online platform allows users to compare multiple marine insurance policies, assess the coverage they provide, and select the one that aligns with their specific needs. The platform is designed with user experience in mind, ensuring that even those unfamiliar with insurance jargon can easily find the right policy.

In addition to offering a wide range of insurance options, DgNote provides personalized recommendations based on the type of cargo being shipped, the value of the goods, and the specific risks involved in the transit route. This level of customization ensures that shippers get the best possible coverage for their unique circumstances.

Moreover, DgNote leverages advanced technology to streamline the insurance purchasing process. With just a few clicks, users can access a comprehensive list of policies, view their benefits, and make informed decisions. This convenience saves time and effort, allowing shippers to focus on their core business while trusting that their cargo is well-protected.

Marine insurance is an essential component of any shipping operation, providing shippers with the financial security they need in the face of potential cargo damage. By offering comprehensive coverage for a wide range of risks, marine insurance protects against the financial impact of unforeseen events such as accidents, theft, and rough weather.

FAQs

1. What is marine insurance and why is it important?

Marine insurance is a type of coverage that protects shippers from financial losses due to cargo damage, theft, accidents, or other unforeseen events during transit. It is essential for ensuring that shippers can recover losses and continue business operations without disruption, even if their cargo is damaged or lost.

2. What types of risks does marine insurance protect against?

Marine insurance covers a variety of risks including rough weather, theft, fire, mishandling, collisions, and water damage. It also protects against unforeseen events such as piracy and accidents during the transportation of goods by sea, air, or land.

3. How does marine insurance provide protection for cargo damage?

Marine insurance offers comprehensive coverage for cargo damage by compensating shippers for losses incurred due to covered risks. Whether it’s damage from storms, theft, or accidents, the insurance helps mitigate the financial impact by covering the value of the damaged goods.

4. What is the claims process in marine insurance?

The claims process involves filing a claim for cargo damage with the insurance provider, submitting necessary documentation (such as proof of damage), and waiting for the claim to be assessed. Once the claim is validated, the insurer provides compensation for the damaged goods.

5. How long does the marine insurance claims process take?

The duration of the claims process can vary depending on the insurance provider and the complexity of the claim. However, reputable insurers strive to process claims efficiently, ensuring timely compensation to help shippers recover their losses as soon as possible.

6. Can marine insurance cover cargo transported by air or land as well?

Yes, marine insurance can cover goods transported by air and land, in addition to sea routes. It offers protection for cargo during its entire transit journey, regardless of the mode of transportation.

7. How do I find the best marine insurance coverage for my shipping needs?

Using platforms like DgNote Technologies can simplify the process of finding marine insurance. DgNote allows you to compare multiple policies, receive personalized recommendations based on your cargo and route, and select the best coverage for your specific shipping requirements.

8. What factors should I consider when choosing marine insurance?

When selecting marine insurance, consider factors such as the type of cargo, its value, the potential risks on your shipping route, and the claims process of the insurance provider. Additionally, choosing an insurer with a strong track record of reliable claims handling is essential.

9. How can DgNote Technologies help me secure marine insurance?

DgNote Technologies offers a user-friendly platform where you can compare multiple marine insurance policies, receive personalized recommendations based on your shipping needs, and choose the best coverage. The platform streamlines the entire process, making it easier and faster to secure the right insurance.

10. What happens if my cargo is lost or damaged due to piracy?

Marine insurance typically covers damage or loss due to piracy, ensuring that you are financially protected against this risk. In the event of piracy-related loss, you can file a claim to receive compensation for the value of the lost cargo.

What's Your Reaction?

.webp)