Life insurance is a crucial financial tool designed to provide security and peace of mind for individuals and their loved ones. Despite its importance, many people lack adequate life insurance coverage. Understanding the reasons behind this trend can help address common concerns and misconceptions surrounding life insurance. This article explores the various factors contributing to the low uptake of life insurance coverage and offers insights into why more individuals should consider it as part of their financial planning.

The Complexity of Life Insurance Policies

One of the primary reasons many individuals shy away from purchasing life insurance is the complexity associated with different policies. With various types of life insurance available, such as term life, whole life, and universal life, navigating the options can be overwhelming. Each type has its own features, benefits, and potential drawbacks, which can create confusion for prospective buyers.

Moreover, many people lack a clear understanding of how life insurance works. They may find it challenging to comprehend policy terms, premium structures, and payout conditions. This complexity often leads to avoidance, as individuals may prefer to forgo the process rather than risk making an uninformed decision that could affect their financial future.

Misconceptions About Life Insurance

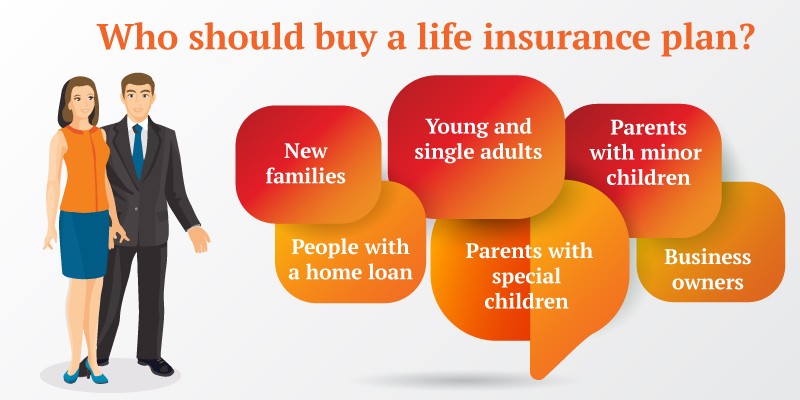

Misconceptions surrounding life insurance further contribute to the hesitance among individuals to secure coverage. Many people mistakenly believe that life insurance is only necessary for those with dependents or significant financial obligations. While it is true that parents or individuals with loans may have a more pressing need for coverage, life insurance can benefit anyone.

Some individuals also perceive life insurance as an unnecessary expense. They may prioritize other financial commitments, such as housing costs, education expenses, or retirement savings, viewing life insurance as a non-essential item. This perspective can lead to the neglect of a fundamental aspect of financial planning, ultimately jeopardizing the financial security of their loved ones.

Affordability Concerns

Affordability is a significant barrier preventing many people from obtaining life insurance coverage. While there are various options available at different price points, potential policyholders often underestimate the affordability of life insurance. Many individuals assume that premiums are out of reach, especially if they are already managing tight budgets.

Moreover, life insurance costs can vary based on factors such as age, health, and coverage amount. Individuals who perceive themselves as being in poor health or older may assume that they will face exorbitant premiums or might even be denied coverage. This perception can deter them from exploring their options and securing coverage that could provide financial protection.

Procrastination and Lack of Urgency

Procrastination is a common issue when it comes to life insurance. Many individuals recognize the importance of securing coverage but often postpone the decision, believing they can address it later. This tendency is especially prevalent among younger individuals who feel invincible and believe they have ample time to consider life insurance.

Additionally, the lack of immediate urgency often contributes to this delay. Many people do not feel an acute need for life insurance until significant life events occur, such as marriage, the birth of a child, or the acquisition of a mortgage. By then, they may face increased premiums or health-related issues that complicate their ability to obtain coverage.

Competing Financial Priorities

Individuals often prioritize various financial goals, such as saving for retirement, purchasing a home, or funding education, which can lead to life insurance being pushed to the back burner. With numerous financial obligations demanding attention, people may feel that they cannot afford to allocate funds to life insurance premiums.

Furthermore, in today's fast-paced world, individuals are bombarded with information about investments, savings, and other financial products. This plethora of options can dilute the perceived importance of life insurance, causing individuals to focus on immediate financial goals instead of considering long-term security.

Negative Perceptions About Insurance Companies

The insurance industry has faced its share of criticism over the years, contributing to negative perceptions about purchasing life insurance. Many individuals harbor mistrust towards insurance companies, stemming from stories of denied claims, poor customer service, or unclear policy terms. This mistrust can deter potential policyholders from engaging with insurance providers and securing coverage.

Additionally, individuals may fear that they will not receive the benefits they are paying for, leading to a reluctance to invest in life insurance. This perception can result in the decision to avoid purchasing coverage altogether, leaving individuals and their families unprotected.

Lack of Knowledge and Awareness

A significant barrier to life insurance coverage is the lack of knowledge and awareness surrounding its benefits. Many individuals simply do not understand the value of life insurance or how it can play a vital role in financial planning.

Educational efforts in financial literacy can greatly impact individuals' understanding of life insurance. By increasing awareness of how life insurance can protect loved ones, cover debts, and contribute to overall financial stability, more individuals may recognize the importance of securing coverage.

Additionally, many people are unaware of the different policy options available to them. Without proper guidance, they may not know how to select the right coverage to meet their needs or how to effectively navigate the insurance marketplace.

Cultural Attitudes Towards Death and Money

Cultural attitudes towards death and financial planning can also influence an individual's willingness to purchase life insurance. In some cultures, discussing death and finances is considered taboo, making it uncomfortable for individuals to approach the subject of life insurance.

Furthermore, cultural norms may shape perceptions of financial responsibility. In some cultures, there may be a belief that family members should provide support for one another in times of crisis rather than relying on insurance coverage. This belief can result in a decreased emphasis on securing life insurance as a necessary part of financial planning.

The Role of Financial Advisors

The role of financial advisors in promoting life insurance coverage cannot be understated. Unfortunately, not everyone has access to financial advisors or feels comfortable seeking professional guidance. This lack of access can prevent individuals from receiving the information they need to understand the benefits of life insurance.

Financial advisors can play a crucial role in educating clients about the importance of life insurance and helping them navigate the options available. They can provide personalized recommendations based on individual circumstances, helping clients recognize the value of securing coverage.

The reasons behind the low uptake of life insurance coverage are multifaceted, ranging from misconceptions and affordability concerns to procrastination and cultural attitudes. Addressing these issues requires education, awareness, and a shift in perspective regarding the importance of life insurance in financial planning.

As individuals navigate their financial futures, understanding the value of life insurance can empower them to make informed decisions that ultimately benefit their loved ones. By acknowledging the barriers preventing individuals from securing coverage, the insurance industry can work towards creating solutions that make life insurance more accessible and understandable for everyone.

ChatGPT said:

FAQs

What is life insurance, and why is it important?

Life insurance is a contract between an individual and an insurance company that provides financial protection to the policyholder's beneficiaries upon their death. The importance of life insurance lies in its ability to offer financial security to loved ones, ensuring that they can maintain their standard of living, cover outstanding debts, and manage future expenses such as education or housing costs. It acts as a safety net during difficult times, alleviating financial stress for grieving families.

Who should consider purchasing life insurance?

While anyone can benefit from life insurance, it is particularly essential for individuals with dependents, such as children or spouses, who rely on their income for financial support. Additionally, those with significant debts, such as mortgages or loans, should consider life insurance to ensure that these obligations do not burden their loved ones. Even individuals without dependents may find life insurance valuable for covering final expenses and leaving a legacy.

What types of life insurance are available?

There are several types of life insurance, including term life, whole life, and universal life. Term life insurance provides coverage for a specified period, usually ranging from ten to thirty years, and pays a death benefit if the policyholder passes away during that term. Whole life insurance offers lifelong coverage with a cash value component that grows over time. Universal life insurance combines features of both term and whole life policies, allowing for flexible premiums and death benefits.

How do I determine how much life insurance coverage I need?

Determining the right amount of life insurance coverage involves assessing your financial responsibilities and future obligations. Consider factors such as your income, debts, living expenses, and the financial needs of your dependents. A common approach is to aim for a coverage amount that is ten to fifteen times your annual income, but it’s essential to tailor this figure to your specific situation. Consulting a financial advisor can provide personalized insights and help you create a more accurate estimate.

How do premiums work, and what factors influence their cost?

Life insurance premiums are the payments made to the insurance company to maintain coverage. Various factors influence premium costs, including the policyholder's age, gender, health status, lifestyle choices (such as smoking), and the amount of coverage desired. Generally, younger and healthier individuals pay lower premiums, while those with higher health risks may face higher rates. Additionally, the type of policy selected can impact premium costs, with term life insurance typically being more affordable than whole life policies.

Can I change my life insurance policy after purchasing it?

Yes, many life insurance policies offer flexibility that allows policyholders to make changes after purchase. Depending on the type of policy, you may be able to adjust coverage amounts, convert a term policy to permanent insurance, or add riders for additional benefits. However, it's essential to review the terms and conditions of your specific policy and consult with your insurance agent to understand the implications of any changes.

What happens if I stop paying my life insurance premiums?

If you stop paying your life insurance premiums, the consequences depend on the type of policy you have. Most term life insurance policies have a grace period during which you can make up missed payments without losing coverage. If you fail to pay within this period, your policy may lapse, and you would lose the death benefit. For whole life policies, the cash value accumulated can sometimes be used to cover premiums, but this can reduce the death benefit. Always check with your insurer to understand your options if you miss a payment.

What are riders, and should I consider adding them to my policy?

Riders are additional provisions that can be added to a life insurance policy to enhance coverage or provide extra benefits. Common riders include accelerated death benefit riders, which allow policyholders to access a portion of the death benefit if diagnosed with a terminal illness, and waiver of premium riders, which waives premium payments if the policyholder becomes disabled. Whether to add riders depends on individual circumstances and needs; they can provide valuable protection but may also increase premium costs. Consulting with an insurance professional can help determine the most beneficial options for your situation.

Can I purchase life insurance for someone else?

Yes, it is possible to purchase life insurance for someone else, provided you have their consent. This type of policy is known as an insurable interest, which means you must have a legitimate reason to insure the person's life, such as financial dependency or a close familial relationship. The insured individual must be aware of the policy and provide their consent during the application process. This ensures transparency and protects the interests of both parties involved.

What should I do if I can’t find my loved one’s life insurance policy?

If you cannot locate a deceased loved one’s life insurance policy, there are several steps you can take. Start by searching their financial records, filing cabinets, or safe deposit boxes for any documentation related to insurance policies. Check with their employer, as many offer group life insurance benefits. You can also contact the National Association of Insurance Commissioners (NAIC) for guidance on searching for unclaimed life insurance benefits. Additionally, consider reaching out to insurance companies directly, providing them with the deceased person's name and Social Security number to help locate any policies they may have held.

How can I ensure my beneficiaries receive the life insurance payout?

To ensure that your beneficiaries receive the life insurance payout, it is crucial to keep your policy information up to date. Designate clear beneficiaries in your policy documents and review this designation periodically, especially after significant life events such as marriage, divorce, or the birth of a child. Communicate your life insurance details to your beneficiaries, informing them of the policy’s existence and where to find the relevant documents. Regularly reviewing your policy and keeping it current can help prevent complications for your loved ones when it comes time to claim the benefits.

Is it too late to purchase life insurance if I am older or have health issues?

It is not necessarily too late to purchase life insurance if you are older or have health issues, but your options may be more limited, and premiums could be higher. Many insurance companies offer policies specifically designed for older individuals or those with health concerns, such as guaranteed issue life insurance, which does not require medical underwriting. While these policies may come with higher premiums or lower coverage amounts, they can still provide valuable financial protection for your loved ones. It’s advisable to shop around and compare different policies to find the best option for your needs.

How do I choose the right life insurance provider?

Choosing the right life insurance provider involves conducting thorough research and considering several factors. Look for companies with strong financial ratings and positive customer reviews, as this indicates reliability and the ability to pay claims. Compare policy options, premiums, and customer service experiences to ensure you find a provider that meets your needs. Seeking recommendations from friends, family, or financial advisors can also provide valuable insights into reputable companies. Take your time to evaluate your options, as this decision plays a crucial role in securing your loved ones’ financial future.

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, usually ranging from ten to thirty years, and pays a death benefit only if the policyholder passes away during that term. It tends to be more affordable and straightforward, making it an attractive option for those seeking temporary coverage. Whole life insurance, on the other hand, offers lifelong coverage and includes a cash value component that grows over time. This cash value can be accessed through loans or withdrawals, but it typically comes at a higher premium. Choosing between term and whole life insurance depends on individual financial goals, needs, and budget.

Can life insurance be used as an investment?

While life insurance is primarily designed to provide financial protection, certain types of policies, such as whole life and universal life insurance, include a cash value component that can be viewed as an investment. The cash value grows over time, and policyholders can access it through loans or withdrawals. However, using life insurance as an investment strategy can be complex, and it's essential to understand the implications, fees, and potential impact on the death benefit. Consulting with a financial advisor can help determine if this approach aligns with your overall financial goals.

What should I do if I feel I’m paying too much for my life insurance?

If you believe you are paying too much for your life insurance, consider reviewing your policy to ensure it meets your current needs. You may find that you no longer require the same level of coverage, allowing for potential adjustments. Additionally, shopping around and obtaining quotes from different insurance providers can help you identify more affordable options. If you are concerned about your policy's terms or coverage, speaking with your insurance agent or a financial advisor can provide insights into potential savings or alternatives that may better suit your financial situation.