Why Parents Over Fifty Need Life Insurance

Discover why parents over fifty need life insurance with our detailed video. We explore the specific reasons why securing life insurance becomes increasingly important as you age, including protecting your family, covering final expenses, and ensuring financial stability. Learn how life insurance can offer peace of mind and security for your loved ones.

As parents age, their priorities and responsibilities evolve. For those over the age of fifty, life insurance can play a vital role in providing financial security for their families. The decision to secure a life insurance policy is often influenced by various factors, including financial stability, health considerations, and the desire to protect loved ones. This comprehensive exploration delves into the reasons why parents over fifty should consider life insurance as a crucial part of their financial planning.

Understanding Life Insurance

Before delving into the specific reasons for obtaining life insurance, it is essential to understand what life insurance entails. Life insurance is a contract between the policyholder and the insurance company, where the insurer agrees to pay a designated sum of money to the beneficiaries upon the death of the insured individual. This financial safety net can help cover a range of expenses and provide peace of mind for both the policyholder and their family.

Financial Responsibilities Change After Fifty

As parents reach the age of fifty, their financial responsibilities often shift. While many may have already supported their children through education and other significant life milestones, the landscape of financial obligations can change dramatically. Parents may still have dependents, such as children who are still in college or even adult children who may be struggling financially. Life insurance can help ensure that these financial responsibilities are met, even in the event of an untimely death.

Providing for Dependent Children

Even as children reach adulthood, many parents continue to support them financially. Whether it’s covering college tuition, helping with a down payment on a house, or providing assistance during a career transition, parents often play a crucial role in their adult children's lives. Life insurance can provide a financial cushion for these dependents, ensuring they have the resources needed to continue their education or manage day-to-day expenses after a parent's passing.

Covering Final Expenses

One of the most significant financial burdens that can fall on surviving family members is the cost of final expenses. Funerals and burial costs can be substantial, and many families are unprepared for these unexpected expenses. Life insurance can cover these costs, allowing loved ones to focus on grieving rather than worrying about how to finance funeral arrangements. By having a life insurance policy in place, parents can alleviate this burden and provide a sense of relief for their families.

Debt Management

Many parents over fifty may still have outstanding debts, such as mortgages, personal loans, or credit card balances. If a parent were to pass away unexpectedly, these debts could become a significant burden for their surviving spouse or children. Life insurance can be used to pay off these debts, ensuring that loved ones are not left with the financial strain of repayment. This can provide invaluable peace of mind and help maintain the family's financial stability.

Income Replacement

For families that rely on a single income, the loss of that income can be devastating. Parents over fifty may still be working or may be in positions where they contribute significantly to the household income. Life insurance can act as a financial safety net, replacing lost income and helping to maintain the family's standard of living. This is particularly important for families with younger children or dependents who may need ongoing support.

Retirement Planning

As parents age, they often start thinking about retirement. However, many may find that their retirement savings are not sufficient to provide for their desired lifestyle. Life insurance can serve as a complementary financial tool for retirement planning. Depending on the type of policy chosen, it may have a cash value component that can be accessed during retirement. This can provide an additional source of income or act as a safety net in case unexpected expenses arise.

Protecting a Business

For parents who own a business, life insurance can play a crucial role in succession planning. If a business owner were to pass away unexpectedly, their family might struggle to keep the business running. A life insurance policy can provide the necessary funds to keep the business operational or facilitate a smooth transition to a successor. This can protect the financial interests of both the family and the business, ensuring that the hard work put into building the business does not go to waste.

Peace of Mind

One of the most important aspects of life insurance is the peace of mind it provides. Knowing that their loved ones will be financially secure in the event of their passing can help parents over fifty enjoy their lives without constantly worrying about the future. This peace of mind allows them to focus on spending quality time with family and friends and enjoying the present moment.

Addressing Health Considerations

As individuals age, health concerns often become more prevalent. Many parents over fifty may face health challenges that could impact their ability to secure life insurance in the future. Purchasing a policy sooner rather than later can ensure that they are covered, even if their health declines. Some insurance companies may impose higher premiums or deny coverage altogether for those with pre-existing health conditions. By obtaining life insurance while still in relatively good health, parents can lock in lower premiums and ensure coverage for their families.

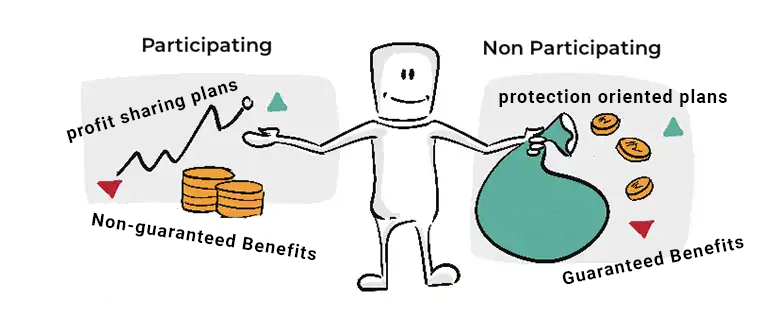

Evaluating Policy Options

When considering life insurance, parents over fifty have various options to choose from. Understanding the different types of policies available is crucial to making an informed decision.

Term life insurance provides coverage for a specified period, such as ten, twenty, or thirty years. This option can be ideal for parents who want to ensure financial protection during their working years or while their children are still dependent.

Whole life insurance offers lifelong coverage with a cash value component that grows over time. This option can be more expensive but provides lifelong protection and potential cash value accumulation that can be used during retirement or for other financial needs.

Universal life insurance combines elements of term and whole life insurance, offering flexible premiums and the potential for cash value growth. This can be a suitable option for parents who want both lifelong coverage and the ability to adjust their premiums as needed.

Consulting with a Financial Advisor

Navigating the world of life insurance can be overwhelming, especially for parents over fifty who are already managing various responsibilities. Consulting with a financial advisor can help them assess their unique needs and determine the best policy options for their circumstances. Financial advisors can provide personalized advice based on individual financial goals, family dynamics, and health considerations.

Regularly Reviewing Insurance Needs

As life circumstances change, so do insurance needs. Parents over fifty should regularly review their life insurance policies to ensure they adequately reflect their current situation. Life events such as marriage, divorce, the birth of grandchildren, or changes in financial responsibilities can all impact the need for coverage. Regularly assessing their insurance needs can help parents make necessary adjustments to their policies and ensure their families are always protected.

The Role of Life Insurance in Estate Planning

Life insurance can also play a significant role in estate planning. For parents over fifty, ensuring that their estate is managed according to their wishes is essential. Life insurance can provide liquidity to cover estate taxes, ensuring that heirs do not have to liquidate assets to pay these costs. This can help preserve the family legacy and ensure that the intended beneficiaries receive their inheritance without financial strain.

Common Myths About Life Insurance

Despite the clear benefits of life insurance, several misconceptions often prevent parents over fifty from obtaining coverage. One common myth is that life insurance is only necessary for younger individuals with dependents. However, as discussed, parents over fifty have unique financial responsibilities that make life insurance essential.

Another myth is that life insurance is too expensive for older individuals. While premiums may be higher for older applicants, there are still affordable options available, especially when purchased while in good health.

Life insurance is a critical component of financial planning for parents over fifty. As they navigate the complexities of aging, financial responsibilities, and family dynamics, having a life insurance policy can provide invaluable protection and peace of mind. By understanding the benefits of life insurance, exploring various policy options, and consulting with financial advisors, parents can make informed decisions that ensure their families are financially secure, regardless of what the future holds.

FAQs

Why is life insurance important for parents over fifty?

Life insurance provides financial security for dependents, covers final expenses, manages debt, and replaces lost income, ensuring that families are supported even in the event of an unexpected loss.

What types of life insurance are available for older adults?

Options include term life insurance, whole life insurance, and universal life insurance, each offering different benefits and coverage terms suitable for various financial needs.

How can life insurance aid in retirement planning?

Some policies have a cash value component that can be accessed during retirement, providing an additional source of income or acting as a financial safety net for unexpected expenses.

What should parents consider when choosing a life insurance policy?

Parents should assess their financial responsibilities, dependents' needs, health status, and long-term goals when selecting a policy to ensure adequate coverage.

Is it ever too late to purchase life insurance?

While obtaining life insurance may be more challenging and expensive as one ages, it is never too late to secure coverage. Parents should consider purchasing a policy while still in good health to lock in lower premiums.

What's Your Reaction?