What Does Liquidity Refer to in a Life Insurance Policy?

Understand the concept of liquidity in life insurance with our guide on What Does Liquidity Refer to in a Life Insurance Policy? This video explains how liquidity affects your policy, including how easily you can access cash value and the implications for your financial planning. Learn about different types of policies and how liquidity impacts your overall benefits.

Understanding the concept of liquidity in the context of life insurance policies is crucial for policyholders, beneficiaries, and anyone considering purchasing a life insurance product. Liquidity refers to the ease with which an asset can be converted into cash without significantly affecting its market value. In life insurance, liquidity pertains to the policy’s ability to provide cash or benefits that can be readily accessed when needed. This exploration will delve into what liquidity means in life insurance, how it works, the different types of policies that offer liquidity, and the implications for policyholders.

Understanding Liquidity in Financial Terms

To grasp the concept of liquidity in life insurance, it is essential first to understand liquidity in general financial terms. Liquidity describes how quickly and easily an asset can be converted into cash. Assets like cash and stocks are considered highly liquid because they can be quickly sold or withdrawn. Conversely, real estate or collectibles might take longer to sell, making them less liquid.

Liquidity is a critical consideration for individuals when managing their financial resources. It ensures that individuals have access to funds when needed, whether for emergencies, investments, or planned expenditures. In the realm of life insurance, liquidity refers to the capacity of the policy to provide cash value or benefits that can be accessed by the policyholder or beneficiaries without facing penalties or delays.

Liquidity in Life Insurance Policies

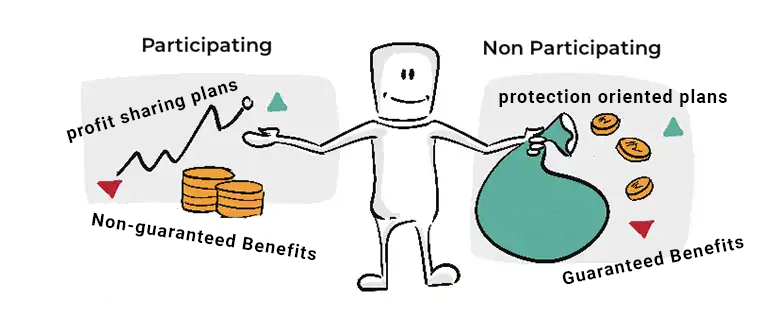

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Understanding how liquidity functions in each of these categories can help potential buyers make informed decisions.

Term Life Insurance

Term life insurance is designed to provide coverage for a specific period, usually ranging from ten to thirty years. This type of policy pays a death benefit to beneficiaries if the insured passes away during the term. However, term life insurance does not build cash value over time, which means it offers limited liquidity.

While term life insurance provides a death benefit that can be substantial, it lacks the liquidity features found in permanent policies. Policyholders cannot withdraw funds or access cash value since there is none built up. Once the term ends, the policyholder has several options, including renewing the policy, converting it to a permanent policy, or letting it lapse. However, in these situations, liquidity remains a challenge because the cash benefit is only available upon the death of the insured.

Permanent Life Insurance

Permanent life insurance, on the other hand, includes policies such as whole life, universal life, and variable life insurance. These policies not only provide a death benefit but also accumulate cash value over time. This cash value component is crucial for understanding liquidity in permanent life insurance.

As the policyholder pays premiums, a portion of these payments goes toward building cash value. This cash value can grow over time, depending on the policy type and performance of underlying investments in the case of variable life insurance. The cash value component enhances the liquidity of permanent life insurance policies, as policyholders have the ability to access these funds.

Accessing Liquidity in Permanent Life Insurance Policies

One of the significant advantages of permanent life insurance is the ability to access the cash value. There are several ways policyholders can utilize this liquidity:

Withdrawals

Policyholders can make withdrawals from the cash value of their permanent life insurance policy. Withdrawals allow individuals to access funds without incurring interest or penalties, as long as the amount does not exceed the total cash value accumulated. However, it is essential to note that withdrawals will reduce the death benefit. If a policyholder withdraws a significant portion of the cash value, it may affect the amount their beneficiaries receive upon their passing.

Loans

Another option for accessing liquidity in permanent life insurance is taking out a loan against the policy’s cash value. This option allows policyholders to borrow money without the need for a credit check or lengthy approval processes. The loan is secured by the cash value, and interest is charged on the outstanding balance. One advantage of borrowing against the policy is that the policyholder does not have to repay the loan immediately; however, any unpaid loan balance plus interest will be deducted from the death benefit when the insured passes away.

Surrendering the Policy

In some cases, policyholders may choose to surrender their life insurance policy altogether. Surrendering a policy involves canceling it and receiving the cash value accumulated minus any surrender charges. This option provides liquidity but should be considered carefully, as it results in the loss of coverage and may not be the best financial decision if the insured is still alive and in need of protection.

The Importance of Liquidity in Life Insurance

Liquidity plays a significant role in personal financial planning. Understanding how liquidity functions within life insurance policies can help individuals align their financial goals with their insurance needs. The ability to access cash when needed can be vital during emergencies, opportunities, or planned expenses.

Emergency Fund

Many people establish life insurance policies to provide financial protection for their loved ones in the event of their death. However, the cash value component of permanent life insurance can also serve as an emergency fund. Policyholders can access their cash value to cover unexpected expenses, such as medical bills or home repairs, providing peace of mind during challenging times.

Supplementing Retirement Income

As individuals approach retirement, they may need additional income sources to supplement their retirement funds. The cash value of a permanent life insurance policy can be tapped into to provide funds for retirement expenses. By carefully managing withdrawals or loans, retirees can maintain financial stability while enjoying their retirement years.

Investment Opportunities

Liquidity within a life insurance policy can also open doors to investment opportunities. Policyholders can utilize the cash value to invest in real estate, stocks, or other ventures. This flexibility allows individuals to grow their wealth while maintaining life insurance coverage for their beneficiaries.

Considerations When Evaluating Liquidity in Life Insurance Policies

While liquidity is a significant advantage of permanent life insurance policies, several considerations must be taken into account when evaluating liquidity in life insurance:

Costs and Fees

Accessing cash value through withdrawals or loans may incur costs and fees. Policyholders should carefully review their policy documents to understand the implications of accessing funds. Surrender charges can significantly reduce the amount received if the policy is canceled early.

Impact on Death Benefit

Any withdrawals or loans taken against the cash value will reduce the death benefit payable to beneficiaries. Policyholders must weigh the immediate need for liquidity against the long-term impact on their loved ones' financial protection.

Policy Performance

The cash value of permanent life insurance policies can fluctuate based on market conditions, interest rates, and other factors. Policyholders should stay informed about their policy's performance and consider how it affects their liquidity options.

Tax Implications

Withdrawals and loans from a life insurance policy can have tax implications. While the death benefit is generally tax-free for beneficiaries, accessing cash value may result in taxable income, especially if the withdrawal exceeds the total premiums paid. Consulting a tax professional can help navigate these complexities.

Final Thoughts on Liquidity in Life Insurance Policies

Liquidity is an essential factor to consider when evaluating life insurance policies. While term life insurance offers a death benefit with limited liquidity, permanent life insurance provides cash value that policyholders can access through withdrawals and loans. Understanding how liquidity works within these policies empowers individuals to make informed decisions about their financial future.

As life circumstances change, the need for liquidity may increase. Whether it is an unexpected expense, an investment opportunity, or a desire to supplement retirement income, having access to cash through a life insurance policy can be a valuable financial resource. Ultimately, individuals should assess their financial goals and needs when selecting a life insurance policy that aligns with their liquidity requirements, ensuring that they are adequately protected while having the flexibility to access funds as needed.

What's Your Reaction?