What is a Participating Life Insurance Policy?

Discover what a participating life insurance policy is in our detailed video. We explain how this type of policy allows policyholders to receive dividends based on the insurer's financial performance. Learn about the benefits of participating policies, including potential dividends, increased cash value, and how they differ from non-participating policies.

A participating life insurance policy is a unique type of whole life insurance that allows policyholders to share in the profits of the insurance company. This is done through dividend payments, which can be used in several ways. Unlike non-participating policies, where the insurance company retains all profits, a participating policy gives the policyholder the opportunity to receive a portion of these earnings.

This policy is particularly attractive to individuals looking for long-term financial benefits beyond the basic death benefit. The dividends paid can either be taken in cash, used to purchase additional coverage, or reinvested into the policy to increase its value over time.

Understanding the Basics of Participating Life Insurance Policies

Participating life insurance is typically offered by mutual insurance companies, which are owned by their policyholders rather than shareholders. This ownership structure allows the company to distribute a portion of its earnings to policyholders in the form of dividends. The concept is simple: when the insurance company performs well, its policyholders benefit.

The dividends are not guaranteed, as they depend on the financial performance of the insurance company. However, when issued, these dividends provide an extra layer of value to policyholders. It’s important to note that dividends can vary year to year based on the insurer’s profitability, investment performance, and claims experience.

How Dividends Work in Participating Policies

Dividends are a key feature that distinguishes participating policies from other forms of life insurance. These payments are typically issued annually and offer policyholders several options for how they can use the dividends.

One common option is to take the dividends in cash. This is an appealing choice for individuals who want immediate access to the additional funds. Alternatively, policyholders can use the dividends to purchase additional life insurance, thereby increasing their coverage without undergoing further underwriting.

Another popular option is to reinvest the dividends back into the policy. This reinvestment increases the cash value of the policy and the overall death benefit, which can be particularly beneficial over the long term.

Some policyholders choose to apply dividends toward paying future premiums. This option can significantly reduce the out-of-pocket cost of maintaining the policy, making it an attractive choice for those looking to minimize expenses.

The Role of Cash Value in Participating Policies

In addition to the potential for receiving dividends, participating life insurance policies also build cash value over time. This is a key feature of whole life insurance policies, including participating policies. The cash value grows based on a combination of premium payments and the interest rate set by the insurance company.

Policyholders can borrow against the cash value of their policy if they need access to funds during their lifetime. The loan is tax-free, but any outstanding loan balance will be deducted from the death benefit if it is not repaid before the policyholder passes away.

The growth of cash value, combined with the opportunity to receive dividends, makes participating life insurance a compelling option for individuals seeking both long-term protection and financial flexibility.

Benefits of Participating Life Insurance Policies

One of the primary benefits of participating life insurance is the potential to receive dividends. These payments offer a form of profit-sharing that is not available with non-participating policies. Dividends can be used in various ways to enhance the value of the policy or to provide policyholders with additional financial resources.

Participating policies also provide guaranteed coverage for the policyholder's entire life, as long as premiums are paid. This lifetime coverage ensures that beneficiaries will receive the death benefit when the policyholder passes away, regardless of when that occurs.

Additionally, the ability to accumulate cash value within the policy offers a level of financial security. Policyholders can access these funds for personal use, making participating policies not only a tool for providing a death benefit but also a flexible financial asset during the policyholder's lifetime.

Another advantage is the stability offered by the insurer. Because dividends are tied to the financial performance of the insurance company, policyholders have the opportunity to benefit from the company's long-term growth and success.

Drawbacks of Participating Life Insurance Policies

While participating life insurance policies offer many advantages, there are also potential drawbacks to consider. One of the main challenges is the cost. Premiums for participating policies are typically higher than those for term life insurance or non-participating whole life insurance. This higher cost reflects the additional benefits and guarantees provided by participating policies.

Another potential downside is the uncertainty surrounding dividends. Since dividends are not guaranteed, policyholders cannot rely on them as a guaranteed source of income or premium relief. The amount of dividends can fluctuate from year to year, depending on the performance of the insurance company.

Additionally, borrowing against the cash value of the policy, while convenient, reduces the death benefit if the loan is not repaid. This can affect the financial legacy left to beneficiaries.

Choosing a Participating Life Insurance Policy

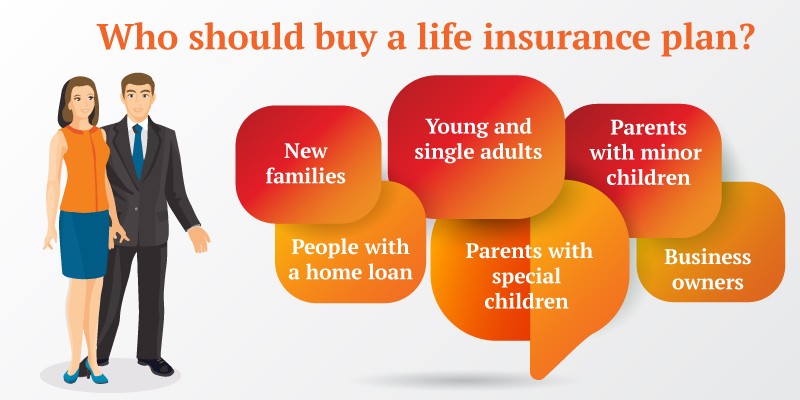

Selecting a participating life insurance policy requires careful consideration of your financial goals and needs. Participating policies are best suited for individuals seeking long-term protection combined with the potential for financial growth. If you are interested in building cash value, receiving dividends, and maintaining lifetime coverage, a participating policy may be a good fit.

It is also important to compare different insurance providers and their dividend track records. Not all companies perform equally, and some have more consistent dividend payments than others. Reviewing an insurer’s financial strength and historical dividend performance can help you make a more informed decision.

Working with a financial advisor or insurance agent can be helpful when considering a participating life insurance policy. They can provide insights into how the policy fits into your broader financial strategy and help you choose the options that best align with your goals.

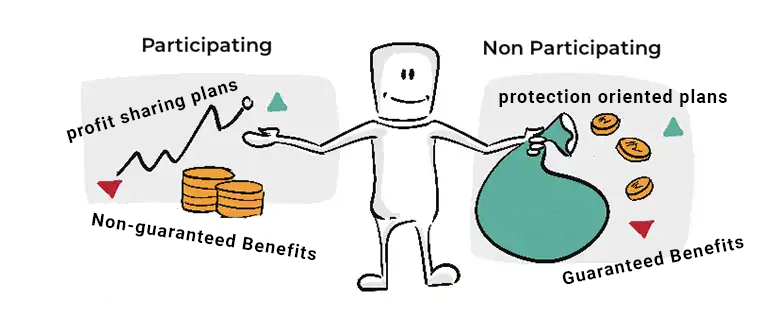

Participating vs. Non-Participating Life Insurance Policies

Understanding the differences between participating and non-participating life insurance is crucial when deciding which policy type is right for you. As mentioned earlier, participating policies provide dividends, while non-participating policies do not.

Non-participating policies generally have lower premiums and provide fixed death benefits and cash values. They do not offer the opportunity for dividends or profit-sharing with the insurance company. For individuals focused solely on life insurance protection without the desire for additional financial growth, a non-participating policy may be more appropriate.

On the other hand, participating policies are more expensive but offer the potential for dividends and greater financial flexibility. Policyholders looking for a comprehensive insurance plan that includes cash value accumulation and the possibility of profit-sharing may find participating policies more appealing.

When Is a Participating Life Insurance Policy a Good Choice?

A participating life insurance policy is a good choice if you are looking for a long-term financial strategy that combines life insurance protection with the potential for additional financial benefits. If you are willing to pay higher premiums for the possibility of receiving dividends and building cash value, a participating policy may be an excellent fit.

These policies are particularly appealing to individuals looking to create a legacy for their family, build wealth over time, or access cash value during their lifetime. The flexibility of using dividends to pay premiums or enhance the policy's value adds another layer of convenience and financial planning.

For those seeking a policy that provides both protection and financial growth, a participating life insurance policy offers a well-rounded option.

Conclusion

A participating life insurance policy offers more than just a death benefit. With the potential for dividends, the accumulation of cash value, and lifetime coverage, these policies provide a comprehensive financial tool for individuals looking to protect their loved ones and build wealth over time. While the higher premiums may be a consideration, the added benefits make participating policies a worthwhile investment for those seeking long-term financial security and flexibility.

FAQs

What is a participating life insurance policy?

A participating life insurance policy is a type of whole life insurance that allows policyholders to share in the profits of the insurance company through dividend payments.

How do dividends work in participating policies?

Dividends are payments made to policyholders based on the insurance company's performance. These dividends can be taken in cash, used to purchase additional coverage, or reinvested into the policy.

Are dividends guaranteed in participating policies?

No, dividends are not guaranteed. They depend on the financial performance of the insurance company and can vary from year to year.

What are the benefits of a participating life insurance policy?

The key benefits include lifetime coverage, the potential to receive dividends, and the ability to build cash value that can be accessed during the policyholder's lifetime.

Are participating policies more expensive than other types of life insurance?

Yes, participating policies generally have higher premiums than term life insurance or non-participating whole life insurance due to the additional benefits they provide.

Can I borrow against the cash value of a participating policy?

Yes, you can borrow against the cash value of your policy, but any unpaid loan balance will reduce the death benefit paid to your beneficiaries.

Who should consider a participating life insurance policy?

Individuals looking for long-term financial protection, wealth-building opportunities, and the flexibility to access cash value during their lifetime should consider a participating life insurance policy.

What's Your Reaction?

:fill(white):max_bytes(150000):strip_icc()/HavenLife-49283207c70446fc93af6e989d6fcb77.jpg)