What Makes People Lapse on Life Insurance Payments?

Discover the common reasons behind why people lapse on life insurance payments in our insightful video. We explore factors like financial strain, lack of understanding of policy terms, changes in priorities, and miscommunication with insurers. Learn how to avoid lapses and maintain your coverage to ensure financial protection for your loved ones.

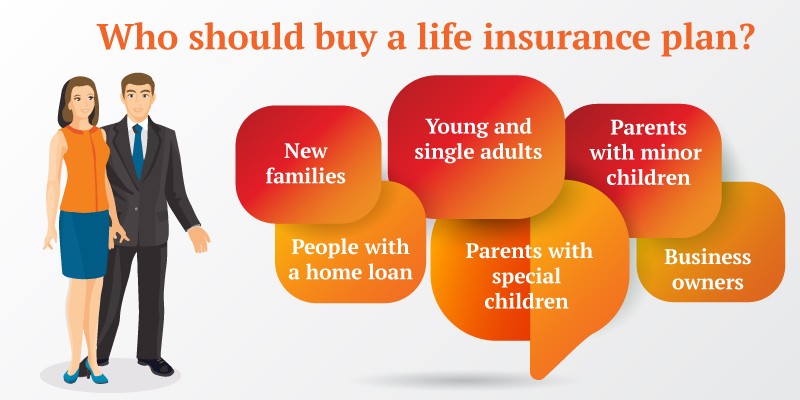

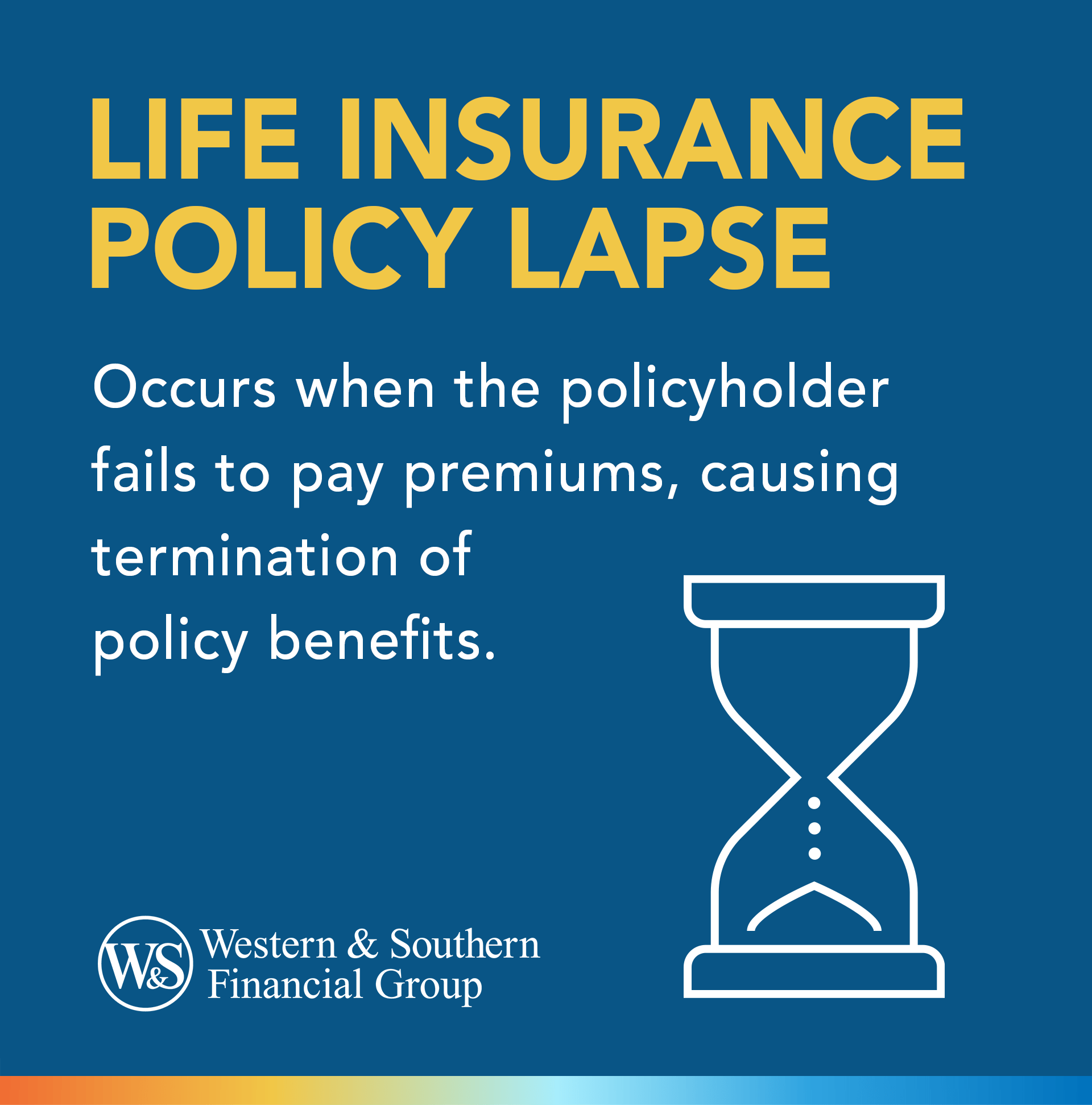

Life insurance is an essential financial tool that provides security to loved ones in the event of an untimely death. However, despite the importance of maintaining life insurance, many people allow their policies to lapse. Lapsing on life insurance payments occurs when the policyholder stops paying premiums, causing the policy to become inactive. Once a policy lapses, the death benefit no longer applies, leaving families without the financial safety net they were counting on. Understanding the reasons behind lapses can help prevent this from happening and ensure the protection remains in place.

Financial Hardship and Strained Budgets

One of the primary reasons individuals lapse on their life insurance payments is financial hardship. Life circumstances such as job loss, reduced income, or unexpected expenses can make it difficult to prioritize insurance premiums. For many, insurance payments may be viewed as non-essential when compared to immediate financial needs like housing, food, or medical bills. Over time, these financial pressures can lead people to stop paying their premiums.

When managing a tight budget, some people may struggle to maintain their insurance payments while juggling other financial obligations. This may cause them to overlook the long-term importance of keeping their life insurance policy active. Life insurance can often be viewed as an unnecessary expense, particularly when people feel overwhelmed by more urgent financial responsibilities. However, the lapse of a policy during a period of financial difficulty can exacerbate an already precarious situation, leaving families vulnerable when they need protection the most.

Lack of Understanding About the Importance of Life Insurance

Another common reason for lapsing on life insurance payments is a lack of understanding regarding the importance of the policy. Some individuals do not fully grasp how life insurance works or why maintaining it is critical. This misunderstanding can stem from insufficient education on the part of the policyholder or poor communication from the insurance company. In some cases, individuals may not realize the full impact that lapsing on their policy could have on their loved ones.

When life insurance is purchased without adequate knowledge, the policyholder may not feel committed to maintaining the coverage long-term. They may assume that the policy is only necessary for a short time or believe that their financial situation will improve enough in the future to renew the policy later. This lack of awareness can lead to neglect in making timely payments, eventually causing the policy to lapse.

Overestimation of Coverage Elsewhere

Many people mistakenly believe that they are sufficiently covered by employer-sponsored life insurance policies or other financial products, leading them to allow their personal policies to lapse. Employer-provided life insurance often comes as part of a benefits package, and while it offers coverage, it typically does not provide enough of a death benefit to fully protect dependents. This overreliance on employer policies can give individuals a false sense of security.

Life changes such as job transitions, retirement, or a reduction in employment benefits may leave people with insufficient coverage if they are only relying on employer-provided insurance. In such situations, individuals may allow their life insurance to lapse under the impression that they are still covered, not realizing the potential risks of depending on a single source of insurance.

Procrastination and Missed Payments

Sometimes, people lapse on their life insurance simply due to procrastination or forgetfulness. Life gets busy, and even important financial commitments like life insurance premiums can slip through the cracks. Automatic payment systems can help reduce this risk, but not everyone opts for this method. Without reminders or structured payment systems, some policyholders may miss payment deadlines unintentionally, allowing their policies to lapse.

When payments are missed, insurance companies typically offer a grace period during which the policyholder can make up the premium and keep the policy active. However, if the payment is not made within this window, the policy will lapse. A combination of forgetfulness, busy schedules, and procrastination can cause individuals to overlook these payments, especially if they are not acutely aware of the consequences of missing a deadline.

Perceived Lack of Immediate Benefit

For some people, the value of life insurance is not immediately apparent because the benefit is only paid out after death. This can create a mindset in which life insurance seems like a distant need rather than an immediate priority. Younger individuals, in particular, may feel that life insurance is something they will need later in life, not realizing that purchasing and maintaining a policy when they are younger is more cost-effective.

This perception of life insurance as a non-urgent expense can lead individuals to let their policies lapse, believing they can always purchase coverage again in the future. However, life insurance becomes more expensive as people age, and existing health conditions may prevent them from qualifying for affordable coverage down the line. By allowing a policy to lapse, individuals may be sacrificing both current and future financial security.

Changing Financial Priorities

As life circumstances change, financial priorities shift as well. Major life events such as the birth of a child, buying a home, or starting a business can cause people to re-evaluate their financial commitments. In some cases, this re-evaluation may lead individuals to deprioritize their life insurance payments in favor of more immediate expenses. With new financial responsibilities, they may decide to forgo their insurance premiums, not fully realizing the long-term implications of allowing the policy to lapse.

People who have paid off major debts or have seen significant changes in their financial situations might also question the need for life insurance, believing that their savings or assets are enough to cover their dependents. This reassessment can lead to a lapse in payments as life insurance may seem less critical at that particular point in time.

Unclear Policy Terms and Confusion

Life insurance policies can be complicated, with terms and conditions that are not always easy to understand. Policyholders who are unsure about the specifics of their policies may feel disconnected from the payment process or unsure of how the policy benefits them. If they do not fully understand what they are paying for, the importance of keeping up with payments may diminish, leading them to stop making contributions and allowing the policy to lapse.

Insurance companies often use legal or industry-specific language that can confuse consumers, leading to frustration and eventual abandonment of the policy. Without clear explanations or ongoing support from their insurer, some individuals may give up on maintaining their policies, not realizing the ramifications of doing so.

Health-Related Factors

For some policyholders, health changes or life-threatening conditions might lead them to stop making life insurance payments. While this may seem counterintuitive, people dealing with serious health issues may prioritize immediate medical expenses over their insurance premiums. In some cases, individuals facing terminal illnesses may assume that their life insurance policy is no longer necessary or that their current health situation renders the policy irrelevant.

Additionally, some life insurance policies contain clauses that limit payouts for specific health conditions, which may lead policyholders to feel that maintaining their policy is not worth the investment if they fall into one of these categories. This misconception can contribute to lapses in coverage.

Lack of Communication from Insurance Providers

Poor communication from insurance providers can also play a significant role in lapses. If insurers fail to provide reminders, updates, or assistance to policyholders, it is easier for individuals to forget about their payments or misunderstand their responsibilities. Inadequate customer service can leave policyholders feeling unsupported, which may lead to them abandoning their policies altogether.

Insurance companies that do not actively engage with their clients risk losing them to lapses. Keeping policyholders informed about their options, payment schedules, and the benefits of maintaining their policies is essential to ensuring long-term engagement.

There are numerous reasons why people lapse on life insurance payments, ranging from financial hardships to misunderstandings about the importance of coverage. Recognizing these factors can help policyholders stay informed and avoid letting their policies lapse. Consistent communication from insurance providers, understanding the policy terms, and planning for the long term can significantly reduce the chances of lapsing and ensure that the protection intended for loved ones remains intact.

FAQs

What causes life insurance to lapse?

Life insurance lapses when policyholders stop paying their premiums. This can happen for various reasons, including financial difficulties, missed payments, changes in priorities, or misunderstandings about policy terms.

Can I reinstate a life insurance policy after it lapses?

Yes, many life insurance companies allow policyholders to reinstate a lapsed policy within a specific timeframe, typically by paying back missed premiums and sometimes providing proof of insurability.

How long is the grace period before a life insurance policy lapses?

Most life insurance policies offer a grace period of about 30 days after the due date of a premium payment. If payment is not made within this period, the policy may lapse.

Does a lapse affect my ability to get life insurance in the future?

A lapsed policy does not necessarily prevent you from obtaining life insurance in the future, but your age and health could affect the cost and availability of coverage if you decide to purchase a new policy.

How can I avoid lapsing on life insurance payments?

To avoid lapsing, consider setting up automatic payments, reviewing your policy regularly, and staying in communication with your insurance provider. Keeping life insurance as part of your financial plan can also ensure that premiums remain a priority.

What happens if I miss a life insurance payment?

If you miss a payment, your insurance provider will typically offer a grace period, during which you can pay the overdue premium without the policy lapsing. If the payment is not made after this period, the policy may lapse.

Is there any refund if my life insurance policy lapses?

In most cases, there is no refund for premiums paid if your life insurance policy lapses. However, some policies may offer a cash surrender value if you voluntarily terminate the policy.

Does employer-provided life insurance protect against policy lapses?

Employer-provided life insurance typically only covers employees while they are employed. If you leave your job or your employer changes its benefits package, you may lose coverage, which can lead to gaps in your life insurance protection.

Why do people let life insurance policies lapse during financial hardship?

Financial hardship may cause people to prioritize immediate needs like housing, food, and medical bills over life insurance payments, which can lead to lapsing the policy. During difficult times, some may view life insurance as a non-essential expense.

What should I do if my life insurance policy lapses?

If your policy lapses, contact your insurer to discuss reinstatement options. You may be able to reactivate the policy by paying back premiums and fulfilling other requirements, such as undergoing a medical examination.

What's Your Reaction?

.jpg)