Top 10 Life Insurance Providers in Jacksonville

Discover the top 10 life insurance providers in Jacksonville for 2024. Our comprehensive guide covers the best options for securing your future with reliable coverage and exceptional service. Make an informed choice with our expert reviews and comparisons.

Overview of the Life Insurance Landscape in Jacksonville

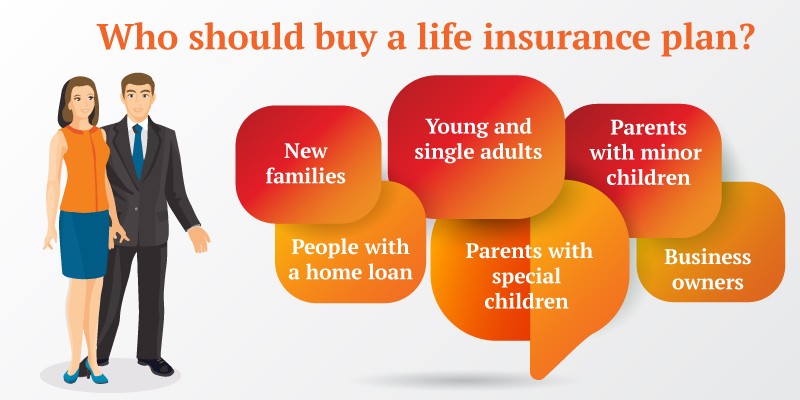

Life insurance is an essential financial tool for protecting loved ones and ensuring financial stability in the event of an unexpected death. In Jacksonville, the life insurance landscape is diverse, offering residents a range of options to suit different needs and budgets. Providers include national giants and regional specialists, each offering various types of life insurance plans, coverage options, and benefits.

Leading Life Insurance Providers in Jacksonville

State Farm

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: State Farm provides flexible coverage with options for term life, which offers protection for a specific period, and permanent life insurance, which covers you for your entire life. Their plans can be customized to include riders for additional coverage.

Premiums: Competitive, with pricing varying based on the type of policy and coverage amount.

Customer Service: Known for excellent customer support and a strong local presence.

Allstate

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: Allstate offers various life insurance products, including term and permanent policies. They also provide options for additional coverage through riders.

Premiums: Affordable, with various pricing tiers to suit different needs.

Customer Service: Highly rated for personalized service and support.

MetLife

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: MetLife provides comprehensive life insurance plans, including term and permanent options. They offer customizable plans with various riders to enhance coverage.

Premiums: Competitive rates with flexible payment options.

Customer Service: Known for responsive customer service and a strong reputation in the industry.

Prudential

Types of Plans: Term Life, Whole Life, Universal Life, Variable Life.

Coverage Options: Prudential offers a broad range of life insurance products, including term and permanent policies, as well as investment-linked options like variable life insurance.

Premiums: Generally competitive, with options to tailor coverage based on needs.

Customer Service: Excellent service with extensive resources for policyholders.

New York Life

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: New York Life provides a range of life insurance products with options for term and permanent coverage. They also offer various riders for enhanced protection.

Premiums: Competitive pricing with flexibility in policy customization.

Customer Service: Highly rated for customer care and financial strength.

Lincoln Financial Group

Types of Plans: Term Life, Universal Life, Variable Life.

Coverage Options: Lincoln Financial offers term and permanent life insurance options, including policies with investment components like variable life insurance.

Premiums: Flexible and competitive, based on the type of policy and coverage amount.

Customer Service: Known for strong support and financial stability.

Northwestern Mutual

Types of Plans: Whole Life, Universal Life.

Coverage Options: Northwestern Mutual specializes in permanent life insurance products, including whole and universal life policies with options for dividend payments.

Premiums: Generally higher due to the focus on permanent coverage, but with potential for cash value growth.

Customer Service: Excellent, with a focus on financial planning and personalized service.

John Hancock

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: John Hancock provides a variety of life insurance products, including term and permanent policies, with options for additional coverage through riders.

Premiums: Competitive, with various pricing options based on coverage needs.

Customer Service: Known for robust support and a range of additional resources for policyholders.

Guardian Life

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: Guardian Life offers a broad range of life insurance products, including customizable term and permanent policies with various rider options.

Premiums: Generally competitive, with flexible payment options.

Customer Service: Highly rated for personalized service and support.

Transamerica

Types of Plans: Term Life, Whole Life, Universal Life.

Coverage Options: Transamerica provides a variety of life insurance products with options for term and permanent coverage. They also offer investment-linked policies.

Premiums: Competitive, with flexibility in policy terms and coverage amounts.

Customer Service: Known for good customer support and comprehensive policy options.

Comparison and Recommendations

For Individuals:

- Best Options: State Farm, Allstate, MetLife. These providers offer flexible term and permanent life insurance policies with competitive premiums and strong customer service. They are ideal for individuals seeking straightforward coverage options and reliable support.

For Families:

- Best Options: Prudential, New York Life, Guardian Life. These providers offer comprehensive coverage options with customizable plans that cater to family needs. They provide both term and permanent life insurance with additional riders for extra protection.

For Seniors:

Best Options: Northwestern Mutual, Lincoln Financial Group. For seniors seeking permanent life insurance with potential cash value growth and strong customer support, these providers offer tailored solutions and financial stability.

Summary

Jacksonville residents have access to a variety of life insurance providers offering diverse options to meet their needs. Whether you are looking for term life insurance for temporary coverage or permanent life insurance for long-term protection, providers like State Farm, Allstate, and Prudential offer competitive plans and excellent customer service. By considering coverage options, premiums, and provider support, Jacksonville residents can find the best life insurance provider to protect their loved ones and secure their financial future.

FAQ:

What types of life insurance plans are offered by the providers listed?

The providers listed offer various types of life insurance plans:

Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). Offers a death benefit if the insured passes away during the term.

Whole Life Insurance: Offers lifelong coverage with a guaranteed death benefit and cash value accumulation.

Universal Life Insurance: Provides flexible premiums and death benefits with a cash value component.

Variable Life Insurance: Includes investment options within the policy, allowing the cash value to grow based on the performance of chosen investments.

How do premiums compare among the top life insurance providers in Jacksonville?

Premiums vary based on the type of policy, coverage amount, and individual factors such as age and health. Generally:

State Farm and Allstate offer competitive rates for term and whole life insurance, making them affordable choices for many individuals and families.

MetLife and Prudential provide flexible premium options with competitive pricing, particularly for permanent policies.

Northwestern Mutual tends to have higher premiums due to its focus on permanent life insurance with cash value growth.

What coverage options are available with these life insurance providers?

Coverage options typically include:

Basic Death Benefit: The amount paid to beneficiaries upon the insured’s death.

Riders: Additional benefits that can be added to a policy, such as accelerated death benefits, disability waivers, and accidental death benefits.

Cash Value Accumulation: Available with whole and universal life policies, allowing the policy to build cash value over time.

How is customer service rated for these life insurance providers?

State Farm and Allstate are known for their excellent customer service with responsive local agents and support.

MetLife and Prudential have strong reputations for customer care, with extensive resources and support available.

Northwestern Mutual and Lincoln Financial Group are highly rated for personalized service and financial stability, particularly for complex needs and long-term planning.

Are there any special considerations for seniors when choosing a life insurance provider?

For seniors, it’s important to consider:

Coverage Duration: Permanent life insurance may be more suitable for seniors due to its lifelong coverage and cash value benefits.

Premium Affordability: Providers like Northwestern Mutual and Lincoln Financial Group offer plans that may be more tailored to senior needs, with options for maintaining coverage into advanced ages.

Policy Features: Look for policies that offer flexible premiums and additional riders for specific needs.

What are the benefits of choosing permanent life insurance over term life insurance?

Permanent life insurance (whole and universal) offers:

Lifelong Coverage: Provides a death benefit for the insured’s entire life.

Cash Value Accumulation: Builds cash value over time, which can be borrowed against or used for future needs.

Fixed Premiums: Premiums may be fixed for the duration of the policy, offering financial predictability.

In contrast, term life insurance offers lower premiums and is ideal for temporary needs but does not accumulate cash value or provide lifelong coverage.

How easy is it to file a claim with these life insurance providers?

The ease of filing a claim varies but generally includes:

Online Claim Submission: Many providers offer online portals for submitting claims.

Customer Support: Providers like State Farm, Allstate, and MetLife have dedicated support teams to assist with the claims process.

Documentation Requirements: Ensure all required documentation, such as death certificates and policy details, are prepared for a smoother claims process.

What should I consider when comparing life insurance providers?

When comparing providers, consider:

Coverage Options: Match the provider’s offerings with your coverage needs.

Premiums: Compare rates for similar coverage amounts and policy types.

Customer Service: Evaluate the provider’s reputation for customer support and ease of claims.

Financial Stability: Choose a provider with a strong financial rating to ensure they can meet their obligations.

Can I customize my life insurance policy with additional features or riders?

Yes, many providers offer customizable options through riders. Common riders include:

Accelerated Death Benefit Rider: Allows access to death benefits in case of terminal illness.

Disability Waiver Rider: Waives premiums if the insured becomes disabled.

Accidental Death Benefit Rider: Provides additional benefits if death results from an accident.

How do I choose the best life insurance provider for my needs?

To choose the best provider:

Assess Your Needs: Determine whether you need term or permanent life insurance and what coverage amount is appropriate.

Compare Options: Look at the different types of plans, premiums, and coverage options offered by each provider.

Check Reviews: Research customer reviews and ratings for service and claims handling.

Consult an Agent: Speak with a licensed insurance agent to get personalized advice based on your specific needs and circumstances.

What's Your Reaction?